What the Creator of the 401(k) Thinks of the Retirement Plan Now

Though 401(k)s are wildly popular, their architect has one big disappointment about them and is on a mission to address it

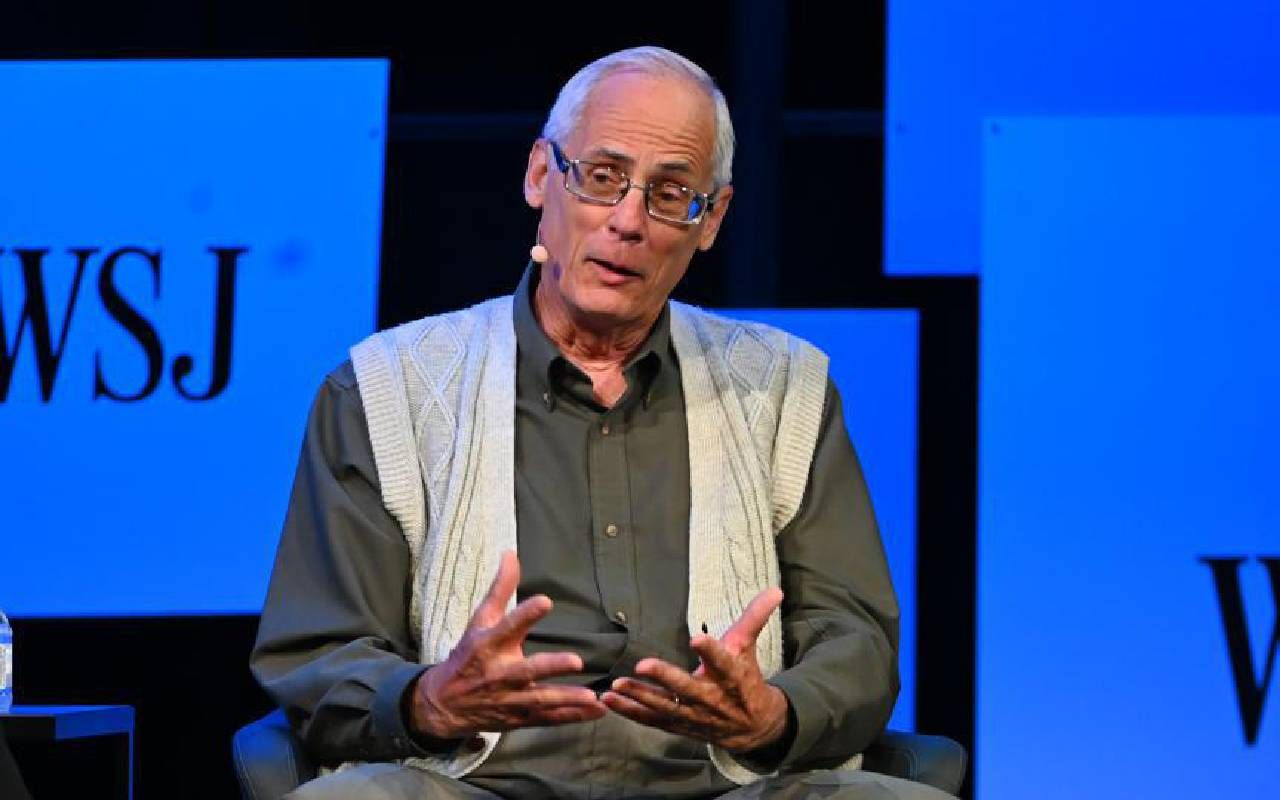

In September 1979, a Pennsylvania benefits consultant named Ted Benna had an idea. What if he used the new section of the Internal Revenue Service code from a law taking effect in 1980, Section 401(k), and created a new type of retirement savings plan for a bank client?

Every employee would be able to contribute a percentage of their cash bonus before taxes and the employer would match a portion — what we now know as the 401(k) plan.

His client rejected the idea, fearing the 401(k) provision would be repealed when the government realized its tax-loss potential. Undeterred, Benna set up a 401(k) for his own firm, The Johnson Companies, starting in 1981.

America's $7.4 Trillion Retirement Plan

Today, Americans have $7.4 trillion in more than 710,000 401(k)s, according to the Investment Company Institute, with an average employer match of 4.5% of pay.

"The 401(k) provision was never intended to be a big deal," said Benna on a recent episode of the Friends Talk Money podcast I co-host with Terry Savage and Pam Krueger. "I turned it into something that was totally different than what was expected."

The 401(k) legislation didn't specifically allow employee pre-tax contributions or employer matches. "But there wasn't anything saying 'thou shalt not.' So, I took the more aggressive interpretation and fortunately that ultimately got blessed by the Treasury Department," noted Benna, who now runs the Benna401k consulting firm in Jersey Shore, Pennsylvania.

Who Doesn't Have or Use a 401(k)?

While millions of Americans with a 401(k) are grateful ("it's helped convert spenders into savers," Benna said), many aren't offered one.

Today, 56% of the nation's workforce lacks access to such plans, according to the Economic Innovation Group, and two-thirds of small business don't offer 401(k)s. Only one in five low-income households headed by someone aged 51 to 64 have 401(k) plans, a recent Government Accountability Office report found and just 36% of Hispanic employees have access to 401(k)s, according to AARP. The Federal Reserve says the median 401(k) balance of the lowest-income savers has dropped since 1996.

Statistics like those gnaw at Benna, who had hoped 401(k)s would become universally available and funded.

"The problem area is the close to 50% who do not have an employer-sponsored program and people earning under $35,000 or so a year, who generally are not going to have enough that they can take part of that off the top and put it into this type of plan," he said.

The Wheat Grain Incentive Plan

Benna is now on a mission to help low- and moderate-income people save, through what he has dubbed the Wheat Grain Incentive Plan.

"I grew up on a farm and the idea is you plant a grain of wheat and it multiplies into multiple grains," Benna explained.

"The 401(k) provision was never intended to be a big deal."

A Wheat Grain Incentive Plan would be an emergency savings plan invested in a safe, tax-deferred money-market account exclusively for a company's low- and moderate-income workers; highly paid employees wouldn't be covered.

"When you have a plan where you exclude the highly compensated employees, you can design it any way you want to and you can provide the 'grains' for whatever reasons you want," said Benna.

As Benna envisions it, such flexibility means employers might put money (the "grains") into the plans for employees who've remained working there or due to outstanding performance or because they've done their jobs safely.

The "grains" could also be given out just because the business has been profitable, too. As Benna explained it, the employer might say: "Hey, we are doing really well. We want to thank you for being a part of that."

Benna's Hope

Unlike a 401(k), there would be no penalty or hardship requirements for taking money out of a Wheat Grain Incentive Plan before retirement.

But, Benna said, he hopes that as the amount in an employee's plan grows beyond $2,500 or $5,000 or so, the worker would be able to roll it over into a Individual Retirement Account or another retirement plan.

No employers have adopted Wheat Grain Incentive Plans yet, but Benna has been talking with benefits consulting firms and expects some companies will give them a try.

"I have not yet been able to get one of the major recordkeeping companies [financial service firms who handle bookkeeping for benefits plans] on board," said Benna. "That probably won't happen until maybe one or more large companies say they're pretty serious about this."

Steep Fees and a Plethora of Choices

Benna is also disappointed with 401(k) plans charging their employees steep fees and providing an exorbitant number of investment choices.

"In the original plans, the employer paid all the costs other than the asset-based fee," Benna said. "And the early plans typically only had two investment options. So, it took only about a minute for me to explain investment choices to the participants."

"The problem area is the close to 50% who do not have an employer-sponsored program."

Today, 401(k) participants are saddled with investment fees, plan administration fees and service fees. Many pay an average fee of 2.2% of their assets in the plan, though some pay as little as .2% and others — especially at small employers — as much as 5%.

The Department of Labor only requires 401(k) fees to be "reasonable." The Secure 2.0 law, enacted in 2022, requires that agency to give Congress by the end of 2025 recommendations on helping employees better understand 401(k) fees. As for the number of 401(k) investment choices, those vary too, but the average plan at Vanguard offered 27.2 investment choices in 2022.

Roughly half of 401(k) participants put their retirement-savings contributions in set-it-and-forget-it target date funds. Here, you choose the year you expect to retire and the target date fund invests accordingly, generally shifting a percentage of your portfolio out of stocks and into bonds and cash as you get older.

Advice for People with 401(k) Plans

Even so, Benna noted, "many participants still have their 401(k) money in four, five or six different funds," including a target date fund. What's more, he added, "some of those target date funds are much more aggressively invested than they should be." Translation: they hold more in stocks for older participants than Benna thinks they should.

Benna's advice to employees: Review your 401(k) plan's fees. If they seem excessive compared to other employers, talk to your benefits department to try to bring your costs down.

"Or the employees can reach out to me. I'll help them if they want. I'll provide the information to their bosses," said Benna.